The Npv Irr Mirr and Discounted Payback

Internal Rate of Return - IRR. Assuming the projects are independent which one or ones would you recommend.

Npv Net Present Value Irr Internal Rate Of Return Payback Period Youtube

Internal Rate of Return IRR 5.

. Net Present Value - NPV. Therefore the firm should accept Project N. If the projects are mutually exclusive which would you recommend Read more.

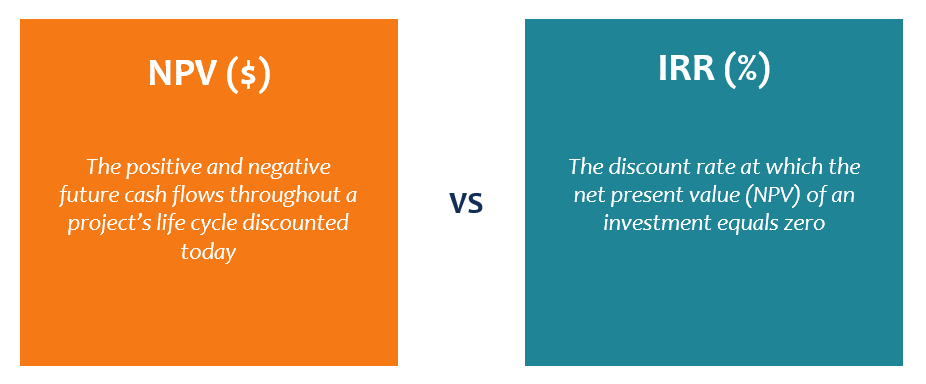

The NPV calculation finds the net present value using a predefined discount rate. 0 Cash Inflow x 1 IRR-time Cash Outflow. Net present value method calculates the present value of the cash flows based on the opportunity cost of capital and derives the.

Payback period NPV IRR Metrics whether to accept or reject the project Memo to CFO Calculations of Key Financial Metrics Discuss overall financial condition of Trinity Capital Budgeting Techiques NPV IRR MIRR Payback Period Discounted Payback Period. Because NPV is positive reject the project if NPV is negative Profitability Index. Calculate NPV IRR MIRR payback and discounted payback for each project.

If NPV 0 accept. IRR finds the discount rate that makes the NPV equal to zero. PI uses a discount rate to discount the future cash flows.

Net present value NPV 4. What is the projects MIRR. The decision rule is based on whether the IRR is higher than NPV Dhiensiri Balsara 2014 p.

D- Compounding Frequencies and Effective Annual rate. Most commonly used techniques include Accounting Rate of Return ARR Payback Period Discounted Payback Period Net Present Value NPV Internal Rate of Return IRR Modified Internal Rate of Return MIRR and Adjusted Present Value APV. Consequently the results of computing the projects discounted payback periods DPBs and MIRR will also show that the projects are acceptable.

NPV IRR MIRR Profitability Index Payback Discounted Payback A project has an initial cost of 60000 expected net cash inflows of 10000 per year for 8 years and a cost of capital of 12. IRR assumes future cash flows from a project are reinvested at the IRR not at the companys cost of capital and therefore doesnt tie as accurately to cost of capital and time value of money as NPV does. Compute the discounted payback period.

Both the payback period and the discounted payback period can be used to evaluate the profitability and feasibility of a specific project. NPV IRR PPAYBACK ROCE. C- Yield to Maturity.

ATo find the MIRR we first compound cash flows at the regular IRR to find the TV and then we discount the TV at the WACC to find the PV. To be acceptable the projects must have DPB 3 and MIRR 12. A modified internal rate of return MIRR which assumes that positive cash flows are reinvested at the firms cost of capital and the initial outlays are financed at the firms financing.

To evaluate the cash flows from capital investment projects. Profitability Index - PI. ARR and Payback period are non discounted methods while all other mentioned methods are discounted.

NPV IRR Payback ROCE. Because the IRR is more than the cost of capital. IRR IRR Problems o Similarly to NPV IRR takes the time value of money and risk into account o IRR is also very intuitive since people and managers are familiar with returns.

The calculations of both NPV and IRR are given here. Because we get our money back even after discounting our cost of capital. When the two models are used together the internal rate of return is chosen if it has a higher rate of return than the NPV model.

Mutually Exclusive projects Payback Discounted. IRR doesnt have this difficulty since it calculates the rate of return. Modified Internal Rate of Return - MIRR.

Other metrics such as the internal rate of return IRR Internal Rate of Return IRR The Internal Rate of Return IRR is the discount rate that makes the net present value NPV of a project zero. The NPV IRR MIRR and discounted payback using a payback requirement of 3 years or less methods always lead to the same acceptreject decisions for independent projects. The NPV IRR MIRR and discounted payback using a payback requirement of 3 years or less methods always lead to the same acceptreject decisions for independent.

Although the IRR and MIRR of Project M is higher than the IRR and MIRR of Project N and the payback period and discounted payback period of Project M are shorter the firm should make the decision based on the NPV because NPV is still the single best capital budget criterion. When IRR rate accept. PVInflows PVInvestment costs or the rate which forces the NPV to equal zero.

Before comparing NPV lets recapitulate the concept again. There are many methods for investment appraisal such as accounting the book rate of return payback period PBP internal rate of return IRR and Profitability Index PI. Discounted payback period method 3.

If a firm uses the discounted payback method with a required payback of 4 years then it will accept more projects than if it used a regular payback of 4 years. A- Goals and objectives of the Corporate Firm and Xenophons new science. NPV requires the use of a discount rate which can be difficult to ascertain.

EThe NPV IRR MIRR and discounted payback using a payback requirement of 3 years or less methods always lead to the same acceptreject decisions for independent projects. The internal rate of return is defined as that discount rate which equates the present value of a projects expected cash inflows to the present value of the projects costs. Using the NPV and IRR techniques because NPV 0 and IRR 12 for both projects.

Calculate NPV-IRR - MIRR - payback and discounted payback. Discounted Payback Period Discounted Payback. O If projects IRR required return r NPV positive o IRR required return NPV zero o IRR required return NPV negative Calculation Example.

EThe NPV IRR MIRR and discounted payback using a payback requirement of 3 years or less methods always lead to the same acceptreject decisions for independent projects. ARR does not have the difficulty of ascertaining an appropriate discount rate. Present Value Cash Inflow or Future Value x 1 rate-time NPV sum of all PV Cash Outflow.

NPV IRR Payback ROCE. Payback also does not use discount rates. Decide to either accept or reject the project Decision Table Evaluation Decision Making Project L Project S Benchmark Decision.

Set NPV to zero. The internal rate of return is used in conjunction with the net present value. What are they used for.

Net Present Value otherwise known as NPV is an accounting term used in capital budgeting where the present value of net cash inflow is subtracted from the present value of cash outflows. Payback Period - Payback. The discount rate is the cost of borrowing or using money for investments.

The decision to accept or reject the purchase depends on the whether the internal rate of return is higher than the discount rate. Cause we make money. To make the accept or reject decision.

Modified Internal Rate of Return MIRR E. Then this value is compared with projected profit ratios for the project in the futureNPV is useful. 1- Define and explain as well as you can of the following.

The discount rate is a critical part of calculating the NPV.

Capital Budgeting Npv Irr Mirr Pi And Payback Youtube

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investing Investment Analysis Analysis

0 Response to "The Npv Irr Mirr and Discounted Payback"

Post a Comment